Trade programs can be highly effective in driving incremental revenue for CPG companies whose trade marketing spend is typically the single largest line item on their income sheets. However, to deliver on an incentive program’s purpose profitably, payouts should be based on what distributors or retailers actually earn rather than estimations, assumptions or outright guesses about reseller sales performance that lead to excessive overpayment, budget waste, diminishment of the promotion goals and negative ROI.

To ascertain the true dollar amount a reseller actually earned requires validating manufacturer product shipments against reseller sales, even though that may involve considerable time, effort and resources. When your trade program’s purpose is to increase volume by rewarding distributors on their product sales volumes, obtaining and properly interpreting their shipment data is crucial to calculating payments correctly. That may sound simple enough to do, but in reality, may not be straight forward. One of the challenging aspects of working with distributor shipment data is accurately interpreting and determining the correct amount of product sold. Why? Product quantities shipped to retailers are represented in various unit measurements. Retailers can order from wholesalers in pallet, case, box, and even individual consumer selling unit quantities. Without collecting data on the consumer selling unit and associated quantity for each item, you may dramatically overestimate the actual unit quantity ordered.

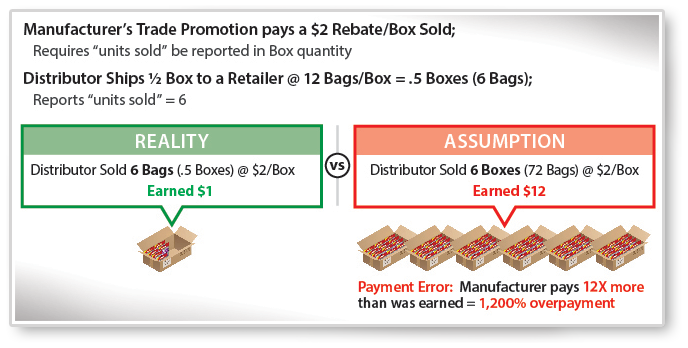

Here is a real life example: A distributor ships a half full box of peg bags of a confection item (packed 12 bags per box) to a retailer, and reports a quantity of six were shipped. The confection manufacturer requires and expects the “sold” quantity to be reported as a box count. Since a box is assumed the selling unit, the distributor must have sold six boxes (72 bags), correct? Or, did the distributor possibly sell and distribute only six peg bags? The wrong assumption could cause a +/- difference of 66 (72-6) bags in this one transaction, and could radically overstate the volume of boxes (and bags) sold.

In MSA’s 20 plus years of experience managing client trade programs, monitoring distributor shipment processes and performing data validation that includes verifying “selling unit” sizes and quantities, we know that distributors DO sell partial boxes to retailers. In my example, the distributor sold a “half box”, or .5 boxes. So, what happens when a half box is reported as a whole box sold, or in this case, six whole boxes? A manufacturer tracking shipped boxes as sold units will overstate unit sales — and, if running a trade promotion on that item, may actually pay out an incentive reward to the distributor inaccurately. In this case, 12 times more than was earned would be paid – a 1,200 percent overpayment that may translate to a major profit-losing error.

Unless a more concerted effort is made to confirm distributor product configurations, significant inaccuracies in sales volume interpretation can occur. We work closely with our clients’ distributor customers to ensure proper ship quantity reporting and require distributors to identify the number of consumer units within the selling unit, alleviating confusion as to the exact quantity sold and shipped to a store. This requirement enables MSA to equalize the volume to any level of package configuration, ultimately revealing when a retailer purchased a partial box or case of product.

***

What do you think of this issue? Are you sure your trade program payouts are 100% accurate? Contact me at MOBrien@MSA.com for a no obligation conversation to explore what areas of your Trade Program Management process can yield greater return on your investment.

by Michael O’Brien – Senior Client Relationship Director