Overcoming challenges brought about by the age of multi-channel choice

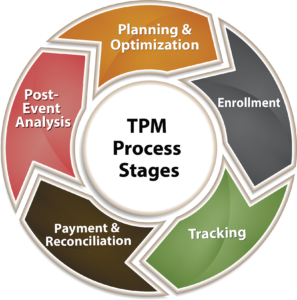

In the swiftly evolving consumer marketplace, driven by multiple generations with very different shopping habits, frequent consolidation of long-standing retail firms, and a growing landscape of traditional and online purchase destinations, the marketing practice of trade promotion management (TPM) is significantly impacted. The sheer cost of trade programs and promotions makes it critically important to align strategies with the expanding demand chain.

The good news is that consumer packaged goods business leaders agree TPM is important and should be modernized and aligned with consumer demands, data proliferation and analytics technology capabilities currently available. The struggle for many is how to move forward to assess and blend current and future needs to make smart, profitable changes in TPM processes and systems that will withstand the test of time over the next decade.

The good news is that consumer packaged goods business leaders agree TPM is important and should be modernized and aligned with consumer demands, data proliferation and analytics technology capabilities currently available. The struggle for many is how to move forward to assess and blend current and future needs to make smart, profitable changes in TPM processes and systems that will withstand the test of time over the next decade.

To prepare for future trade promotion management success, here are some key points to consider:

Move beyond isolated trade promotion planning. Take a more integrated, strategic view of trade program investment.

To keep pace with the growth in channel options, CPG manufacturers are expanding to engage consumers in non-traditional ways: capturing them digitally, moving to direct-to-consumer incentives, e-mail couponing and loyalty programs, and managing and promoting a portfolio of products. Solution providers can help with the need to integrate the supply chain to create awareness and address the lift that new demand is generating to ensure product availability, especially of top-selling items. Allocating the right amount of product to multiple customer types with varying degrees of inventory requirements is critical to profitable outcomes across programs and accounts.

Be aware of obstacles to broad adoption of trade promotion optimization (TPO). Start by maximizing existing program results.

TPO solutions are only one of many tools that CPG leaders use to track, measure and increase product adoption by resellers and consumers. It can be difficult to identify which tools to consider while questioning how much to invest in other tactics (packaging, pricing, planograms, merchandising, advertising, social media) to drive a product’s expected sell through rate. When you divide up tactics and efforts across multiple budgets and functional areas such as strategy, marketing, sales and international, it can be challenging to get corporate alignment on promotion strategy and spend allocations.

Since improving the planning and optimization of trade promotions is seen as a basic need by a large majority of CPG companies, a good place to start is learning why certain current promotions are falling short of expected performance. CPG firms can maximize results, and reduce abandonment of otherwise lucrative trade events, by uncovering and taking action on gaps in store enrollment and product volumes necessary to achieve earned payment compliance. This is done best by utilizing integrated data sets with tools and pre-built analytics that calculate and report chain and store-level order results, and allow drill down through category and brand to item level granularity.

Trade spend should drive new product introductions to maximize revenue and ROI.

In the not-so-distant future, even up to 10 years out, trade promotion spend will likely be much more aligned with new product launch and portfolio rather than with brand management. Direct-to-consumer marketing will increase in the promotion space. As the consumer journey changes, TPO will also need to adapt to subscription, online, curbside pick-up and delivery shopping.

New products will still need placement incentives at retail – or in the endless aisle, or other hybrid displays between virtual and physical – to build consumer awareness, demand and availability. In addition, we expect to see growth in incentives at the point of pickup; incentives for limited availability and shelf-life products (better for you, healthful snacking), and incentives based on continued product loyalty.

MSA is well-known for its trade program management capabilities. We have been managing CPG client trade programs for over 20 years,  and currently manage billions in trade funds. But, the backbone of any TPM system is the quality of the data, especially sales-related data. When a product’s distributor, broker, traditional retailer, e-commerce merchant or combination of all), ensuring the various data sets are aligned, integrated, and ultimately represent actual sales performance “reality” is paramount to making proper trade spend judgements and decisions. Harmonizing, storing, maintaining and delivering clean data, also referred to as a firm’s “single source of truth”, is MSA’s specialty. As other TPM/TPO industry leaders have advocated, without clean data, companies are hard pressed to optimize their trade promotion or trade program investment strategies.1

and currently manage billions in trade funds. But, the backbone of any TPM system is the quality of the data, especially sales-related data. When a product’s distributor, broker, traditional retailer, e-commerce merchant or combination of all), ensuring the various data sets are aligned, integrated, and ultimately represent actual sales performance “reality” is paramount to making proper trade spend judgements and decisions. Harmonizing, storing, maintaining and delivering clean data, also referred to as a firm’s “single source of truth”, is MSA’s specialty. As other TPM/TPO industry leaders have advocated, without clean data, companies are hard pressed to optimize their trade promotion or trade program investment strategies.1

***

What do you think of this topic? Do you utilize integrated tools and systems that enable trade spend planning? Are you getting your resellers’ sales data and retrieving the necessary insights to plan trade program execution effectively? Or, can you use some help in this area? Contact our Information Management Solutions team for a no obligation conversation to explore what areas of your TPM process or systems can yield better outcomes and a greater return on investment.

As other TPM/TPO industry leaders have advocated in the Tech Solution Guide article, “2019 Trade Program Management Solutions Guide”, published February 2019, without clean data, companies are hard pressed to optimize their trade promotion or trade program investment strategies.

1 “2019 Trade Program Management Solutions Guide.” Consumer Goods Technology (CGT), February 2019, pp. 30-42.